3 important legal changes that will affect companies and self-employed workers with economic activity

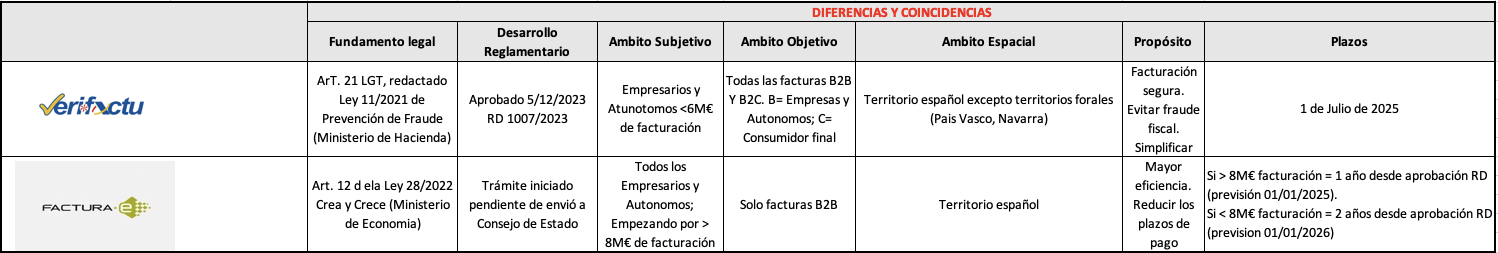

1) The “Verifactu” anti-fraud law, 2) The “Create and Grow” Electronic Invoice and Delinquency Law and 3) The Franchise Regime.

18/12/2023

Boosting Billing with a3factura software: Efficiency and Compliance with Legislation

Puigverd Assessors recommends reviewing the billing software to verify that they adapt to the first two reported changes. If you do not have billing software, a3factura is positioned as a key tool for companies seeking to comply with the provisions of the “Verifactu” Anti-Fraud Law and the “Create and Grow” Electronic Invoice Law .This program not only simplifies the issuance of electronic invoices and compliance with Verifactu, but also offers advanced functions for the comprehensive monitoring and management of tax documents, also facilitating the exchange of information with our office. It is important not to wait until the last minute, so we recommend the implementation of this software in 2024, also taking advantage of the DIGITAL KIT subsidies that will end at the end of 2024 .

The “Verifactu” anti-fraud law

This legislation promoted by the Tax Agency has the main objective of fighting tax fraud and promoting the digitalization and automation of business tax processes. These would be the main points of this law:- It directly affects both manufacturers and marketers of billing software as well as entrepreneurs and self-employed workers with economic activity subject to Personal Income Tax or Corporate Tax. It does not affect companies that are already covered by the SII .

- Disappearance of obsolete billing registration and management techniques (non-digital systems such as the use of office format templates -Excel, Word..., etc....).

- Billing software applications must meet these requirements:

- Generation of a billing record for each new invoice issued simultaneously or immediately prior to the issuance of the invoice, guaranteeing its integrity, inalterability, accessibility, legibility, conservation, traceability, etc. (invoices cannot be modified once generated, if there is an error in the invoice, a corrective invoice must be made and the correct invoice must be generated again).

- Allow each billing record to be automatically sent to the tax agency simultaneously with the issuance of the invoice – a system recommended by the administration called “ verifactu ”.

- Record events to allow traceability of the activity in the billing program.

- Certify through a responsible declaration that the IT solution complies with the provisions of the General Tax Law and the regulation RD 1007/2023.

- Computer systems will need to add a fingerprint or “Hash” to billing records.

- The recipient of the invoice may provide the information to the Tax Agency by reading the QR code on the invoice through the Web or an AEAT app.

- The taxpayer has two options: electronically sign the billing records or send the billing records automatically and securely to “VERIFACTU”.

- Entry into force: Taxpayers must be adapted prior to July 1, 2025 . (RD 1007/2023 of 5/12/2023). Pending Ministerial Order regulating technical aspects.

- Penalty regime: Fixed fine of €50,000 per year for possession of computer systems or programs that do not comply with the provisions of article 29.2.j) LGT.

The Electronic Invoice Law "Create and Grow"

In the current digitalization era, legislation is advancing to adapt to new technologies and improve efficiency in business processes. This legislation promoted by the Ministry of Economic Affairs and Digital Transformation (Community Directive Adaptation) aims to promote the use of electronic invoices in commercial transactions between entrepreneurs (companies and self-employed) “B2B” and the reduction of late payments in commercial operations.These would be the main points of this law:

- All entrepreneurs (companies and self-employed persons) must issue, issue and receive electronic invoices in commercial relationships with other B2B entrepreneurs (companies and self-employed persons).

- All entrepreneurs (companies and self-employed workers) must use technological solutions that guarantee interconnection and interoperability between the different platforms for free.

- All entrepreneurs (companies and self-employed persons) must electronically accept or reject the electronic invoices received and electronically report the date of payment of the invoices within certain deadlines.

- The entry into force is pending the approval of the Regulation of the Electronic Invoice Law "Create and Grow". Predictably:

- Companies and Self-Employed that invoice more than €8M/year must issue electronic invoices starting January 1, 2025 (12 months from RD approval).

- Companies and Self-Employed that invoice less than €8M/year must issue electronic invoices starting January 1, 2026 (24 months from RD approval). However, clients who invoice more than €8M may require or recommend that their suppliers issue electronic invoices prior to this date.

- Entry into force of the obligation to report on the status of the invoice received (accepted, rejected) and the payment date will be different depending on the volume of billing, and the type of business owner (company, self-employed professional, other self-employed). The approval of the Regulation of the Electronic Invoice Law "Create and Grow" is pending. Predictably, 36/48 months from RD approval for communication of effective payment date for companies with a turnover of less than €6M ( 01/01/2027-01/01/2028 ).

- Penalty regime: Up to €10,000 for companies that, being obliged, do not offer users the possibility of receiving electronic invoices.

Franchise Regime: Stimulus for Investment and Business Development

It is a draft Project that is presented as an attractive option to promote investment and business development. This regime offers tax benefits and administrative simplifications that encourage business expansion under the franchise model.These would be the main points of this draft project :

- Applicable to self-employed persons with economic activity, although companies may be included.

- This regime would mean not having to invoice VAT, and therefore not being able to deduct VAT.

- Voluntary regime (Not all obligated parties find its application profitable).

- Applicable to activities with an annual turnover (turnover) of less than €85,000 (could reach €100,000).

- The billing and registration obligation is maintained.

- Disappearance of special regimes: Equivalence Surcharge, Modules (Simplified VAT Regime and Objective Income Estimation). For everyone, whether they give up the system or not.

- Specific activities or operations may be excluded (transport sector, occasional sale of real estate, vehicle deliveries...).

- Entry into force. It is expected 2025.